Markup on total cost transfer pricing formula

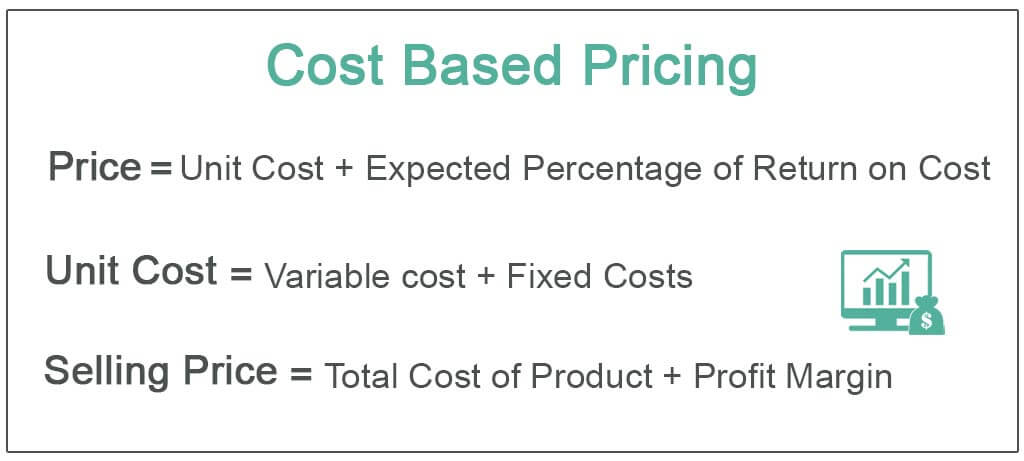

Full cost plus pricing is a price-setting method under which you add together the direct material cost direct labor cost selling and administrative costs and overhead costs. If the company goes for the actual full cost transfer price they will add fixed cost.

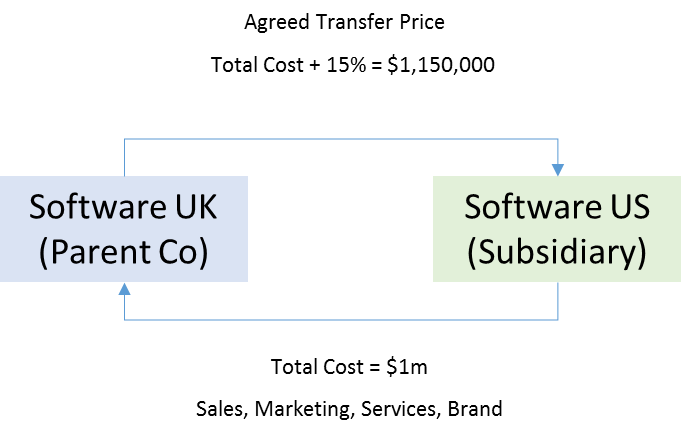

If Your Business Has A Foreign Entity You Must Get Transfer Pricing Right Here Is Why By Will Gibbs Octopus Ventures Medium

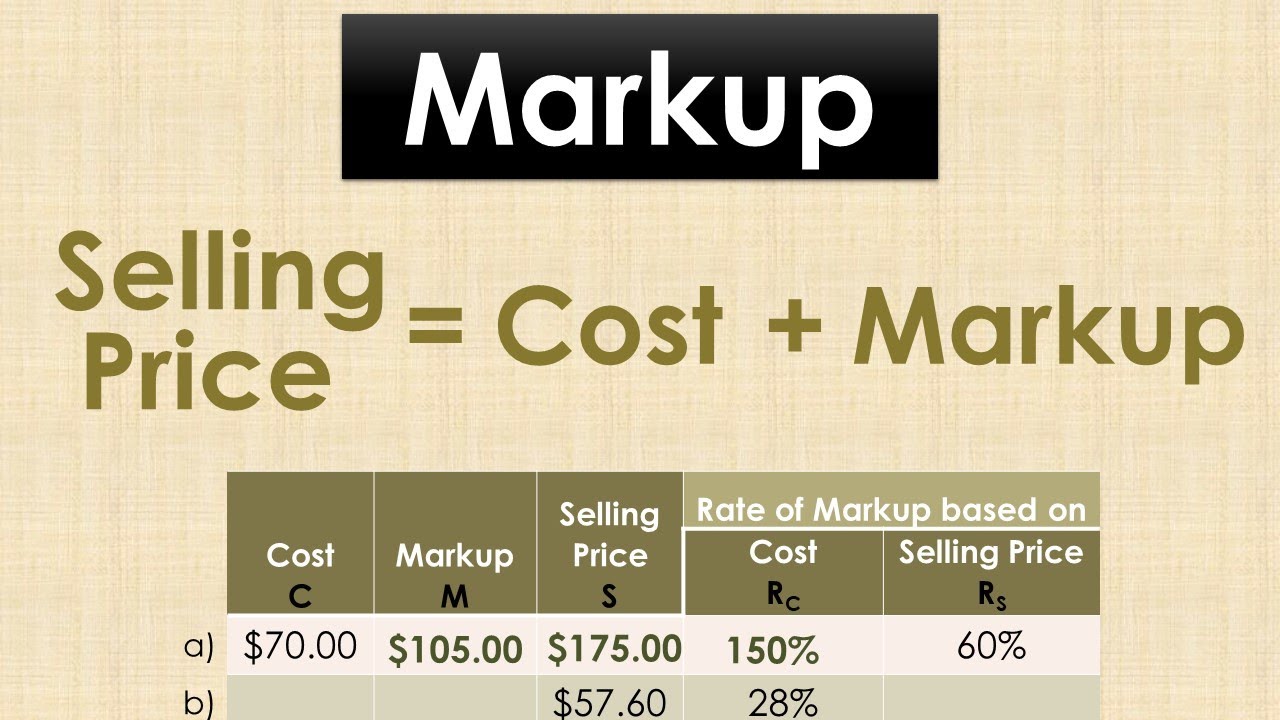

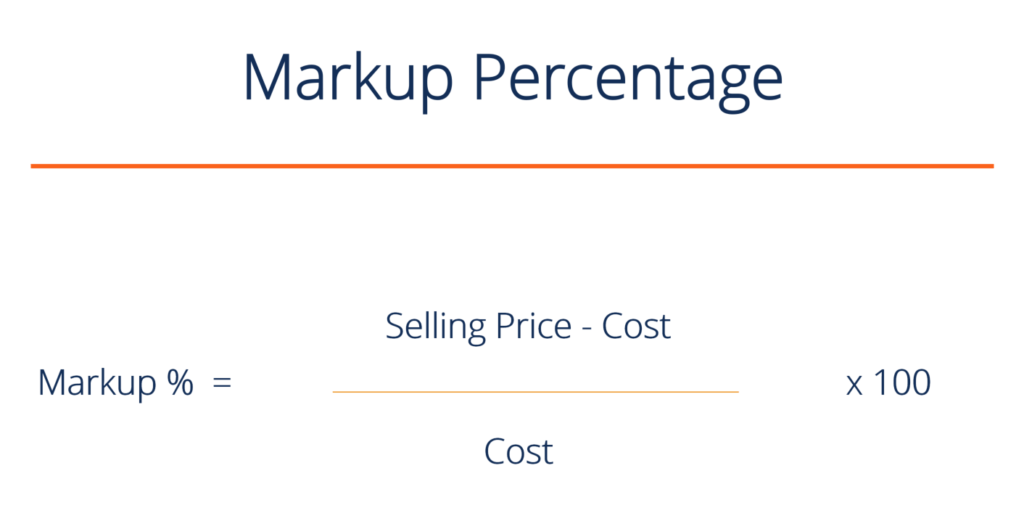

Understanding the markup Markup The percentage of profits derived over the cost price of the product sold is known as markup.

. Selling Price Total Cost Margin. Markup-on-Cost Pricing Method Using this method markup is reflected as a percentage by which initial price is set above product cost as reflected in this formula. Rent for the premises.

Markup Percentage 100 Sale price Cost PriceCost. Markup Percentage 100 500 150150 100. How to use the cost-plus pricing formula.

A formula for Markup Percentage is. The CUP Method compares the terms and conditions including the price of a controlled transaction to those of a third. Cost of Goods Sold COGS The COGS method generates a selling price per unit by calculating the Cost of Purchase COGS per unit.

From the formula of markup percentage we know. Full-cost pricing is one of. It is determined by dividing the companys total profit by the.

Total production costs selling and administrative costs markup the number of units expected to sell. Assuming the fixed costs are. The following is the cost-plus pricing formula.

Price Cost per unit 1 Percentage markup Lets take an example. To use the cost-plus pricing method take your total costs direct labor costs manufacturing shipping etc. In the example shown below the Retail - A price is marked up by 75 since the Cost is less than 2 the 2nd.

For example say a pottery company purchases a vase at wholesale for 50 and needs to sell. Transfer Pricing Method 1. A clothing company reports its production costs.

Now the formula becomes cost 100 percent markup x 100 selling price. The name says it all. The Retail - A and Retail - B pricing is based on the bracketed formula.

The Five Transfer Pricing Methods Explained With Examples

The Cost Plus Method With Example Transfer Pricing Asia

Tp Bible Twitter પર 2 Of The Most Commonly Used Profit Level Indicator Pli As Mentioned In 3 20 Transferpricingguidelines The Image Shows The Formula As Well As Different Common Denomination Any Other

Cost Based Pricing Definition Formula Top Examples

Cost Allocation Meaning Importance Process And More Learn Accounting Accounting Education Cost Allocation

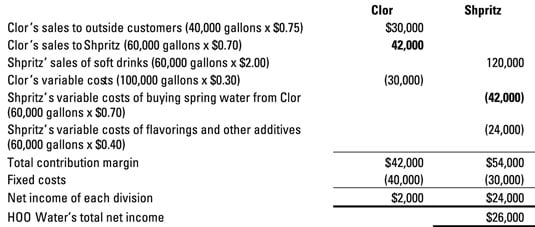

Transfer Pricing F5 Performance Management Acca Qualification Students Acca Global

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Cost Plus Pricing Definition Method Formula Examples Video Lesson Transcript Study Com

Base Transfer Price On Full Cost Dummies

Transfer Pricing Method

Markup Selling Price Cost With Solved Problems Youtube

Transfer Pricing Method

Full Cost Transfer Pricing Youtube

Markup Learn How To Calculate Markup Markup Percentage

Transfer Pricing Method

The Transactional Net Margin Method Explained With Example

Markup Calculator Calculate The Markup Formula Examples