49+ where do i enter mortgage interest on tax return

Web Open your return. If they are incurred for the purpose of earning income by renting.

Mortgage Interest Tax Relief Everything You Need To Know Uk Salary Tax Calculator

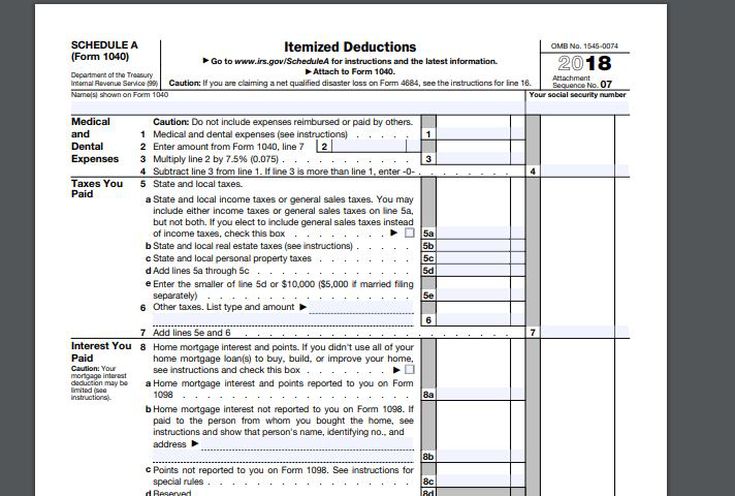

Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the.

. Home mortgage interest limited If. Box 3 Mortgage origination date. For tax year 2022 those amounts are rising to.

Web Line 10 Enter on line 10 mortgage interest and points reported to you on federal Form 1098 Mortgage Interest Statement. Web TurboTax Canada. Web Where do I enter mortgage interest.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. The monthly expense also covers the real estate taxes on our home. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Filing your taxes just became easier. Web You enter mortgage interest received just AS IF you had received a form 1099-INT from a bank. Web On your 1098 tax form is the following information.

Web 2 hours agoFor the third quarter of 2023 we expect billings to be in the range of 220 billion to 225 billion an increase of 22 to 25. Web 11 hours agoTuesday April 18 2023 is the tax filing deadline for most Americans. Web The IRS places several limits on the amount of interest that you can deduct each year.

TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back. Web My housemate and I both the legal owners of our house pay mortgage expenses from our joint account. Box 1 Interest paid not including points.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Ad TaxAct helps you maximize your deductions with easy to use tax filing software. TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back.

We expect revenue to be in the range. Taxslayer Is the Easiest Way To File Your Federal and State Taxes Online. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to. Beginning in 2018 the. In TurboTax you can enter your form 1099-INT by following these.

Box 2 Outstanding mortgage principle. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Mortgages can be considered money loans that are specific to property. 11 the IRS announced that California storm victims now have until May 15 2023 to. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

Ad Every Tax Situation Every Form - No Matter How Complicated We Have You Covered. File your taxes stress-free online with TaxAct. If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction.

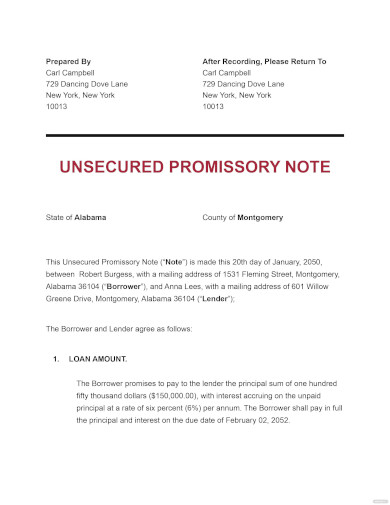

71 Sample Promissory Notes In Pdf Ms Word Google Docs Apple Pages

Solution Class 11 Math S Chapter 15 Statistics Studypool

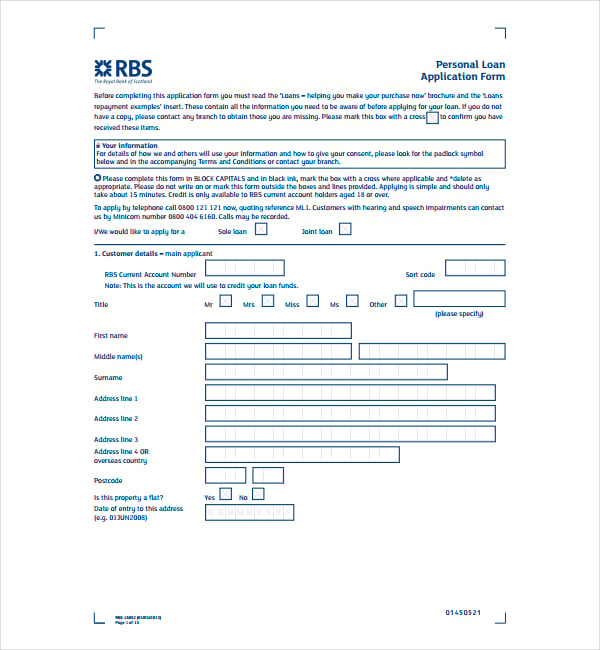

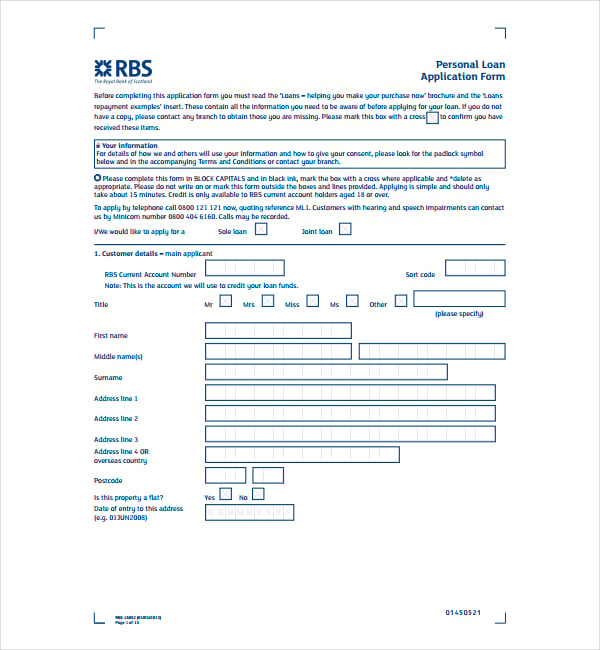

8 Loan Application Form Templates Word Pages Google Docs Pdf

Sf 3

424h

Pdf Tqm Of Unilever Akhi Nur Academia Edu

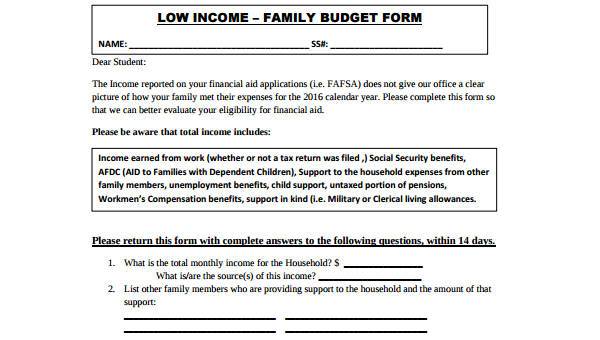

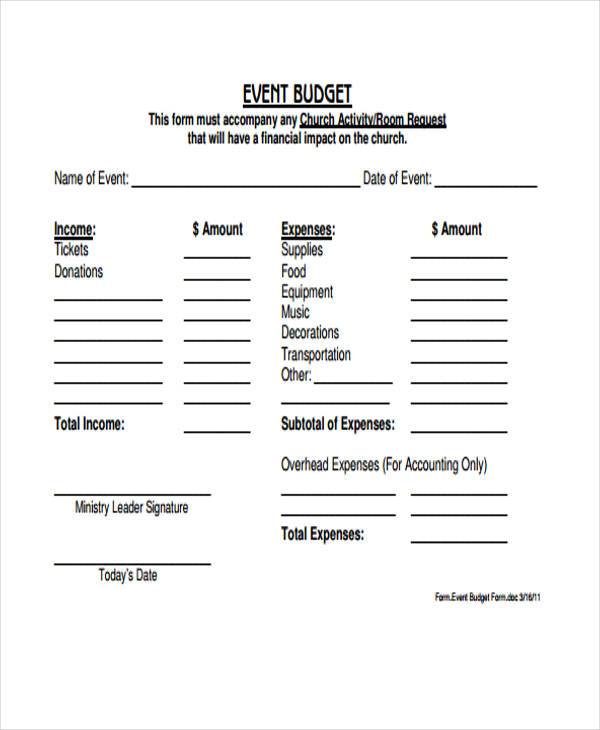

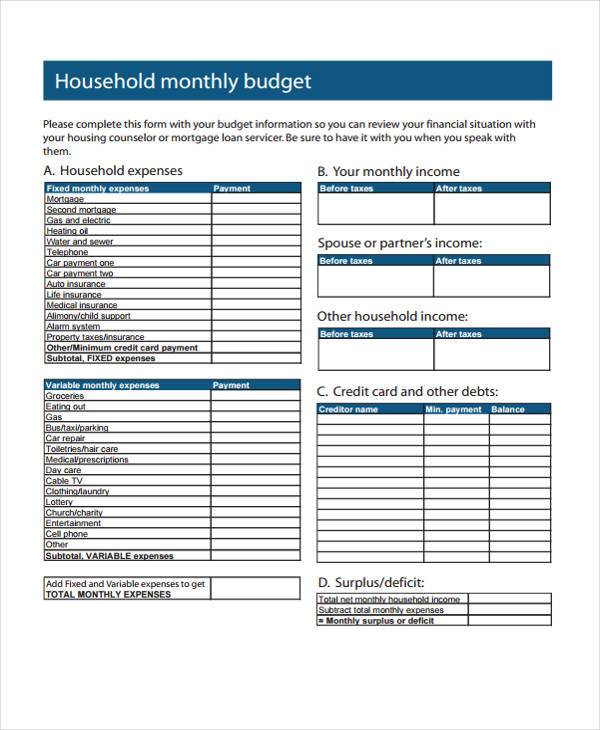

Free 49 Budget Forms In Pdf Ms Word Excel

Cecilton Warwick Road Warwick Md 21912 Mls Mdcc174612 Listing Information Long Foster

Nord Lb Group Annual Report 2007 Pdf 1 8

Effective Tax Rate Matters Evolved Tax Planning Southeast Mortgage

What Line Do You Use To File Mortgage Interest On Form 1040

Pdf Families Incomes And Jobs

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Free 49 Budget Forms In Pdf Ms Word Excel

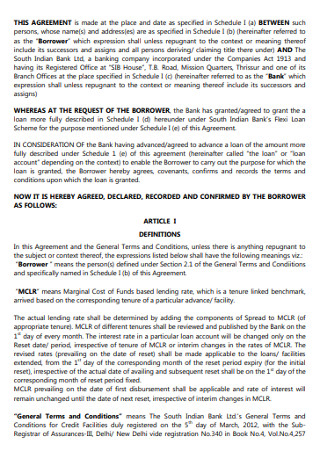

50 Sample Facility Agreements In Pdf Ms Word

Eu Council Manual Law Enforcement Information Exchange 7779 15

Free 49 Budget Forms In Pdf Ms Word Excel